STAY INFORMED AND SECURE!

Your security is our top priority! This is WHY we are offering alerts for your debit card purchases. The service is FREE and helps protect you and your finances.

If suspicious activity is detected on your account, here is what will happen, and how you can take CONTROL:

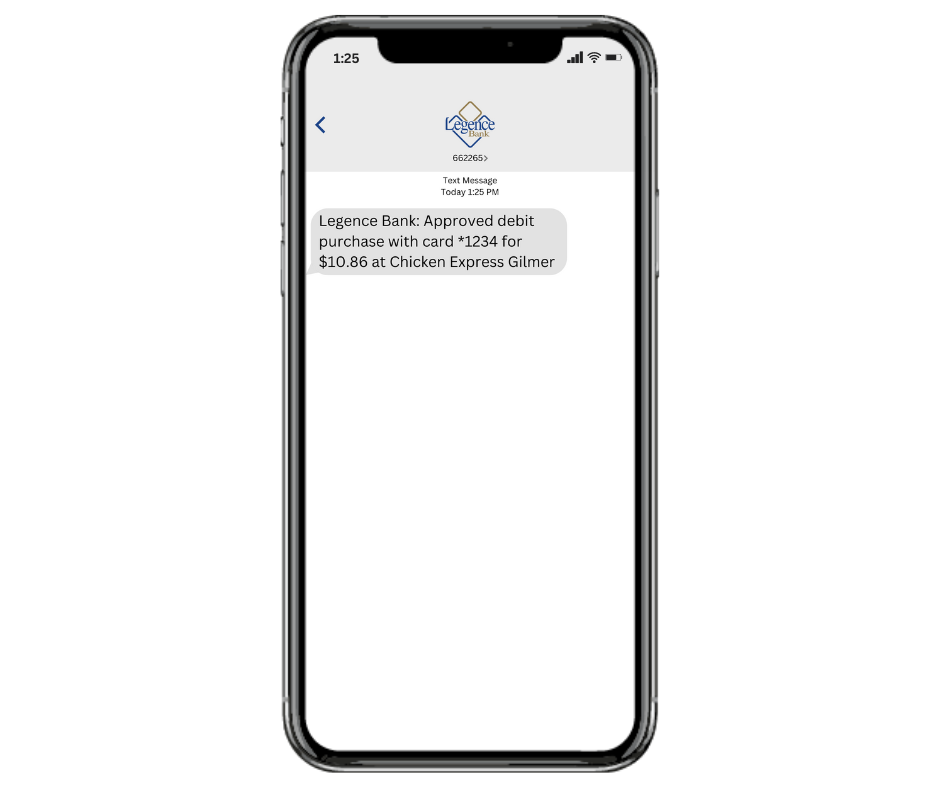

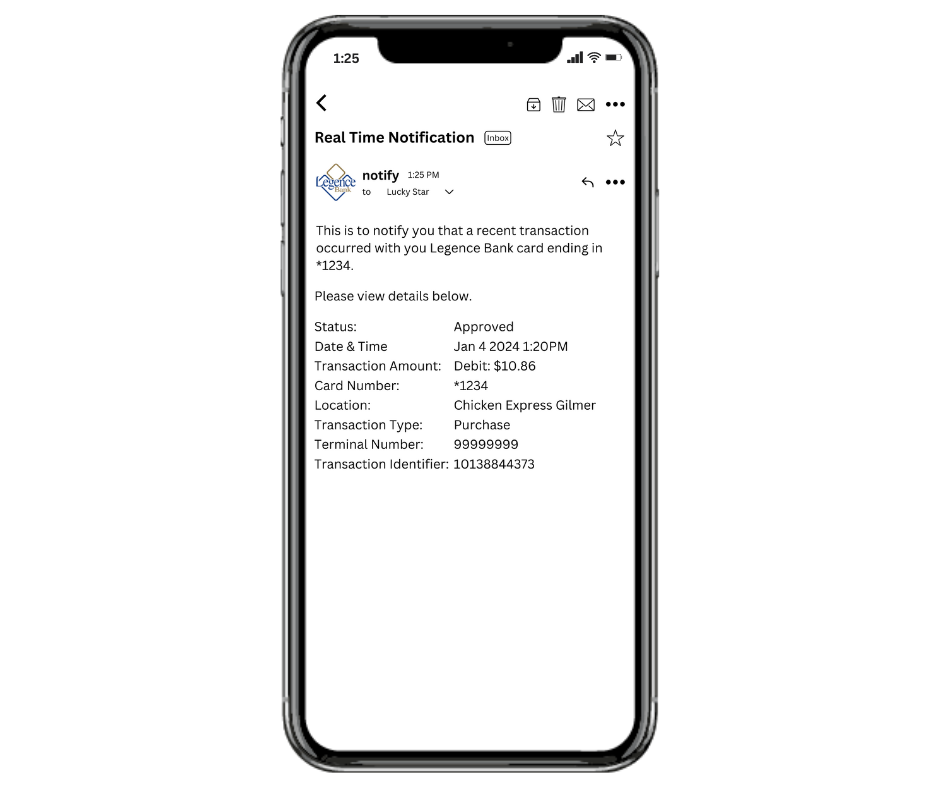

- You will receive an alert via email or text message

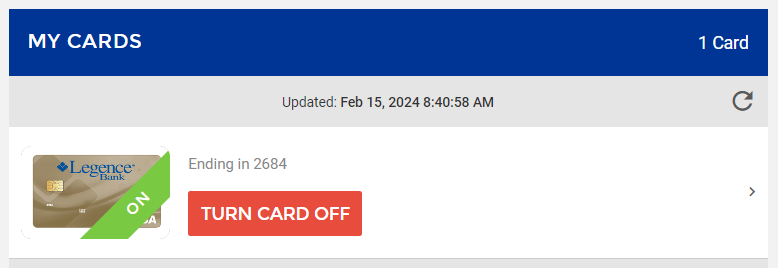

- If you don’t recognize the transaction, lock your debit card using Card Controls in our online banking/mobile app platforms.

- Contact any team member at your local branch and we will help you review the recent transactions and suggest additional steps to keep your account secure.

Keep your finger on the pulse with Debit Card Alerts and Card Controls at Legence Bank.

Rely on automatic, always-on alerts to keep your accounts secure.

Enroll in Debit Card Alerts

FEATURES and BENEFITS

{beginAccordion}

Debit Card Alerts

- Transaction Amount

- Vendor/Business

- Transaction type (eCommerce, ATM, in-store, etc.)

TEXT ALERTS

EMAIL ALERTS

Report Lost, Stolen, or Damaged

- Go to your mobile app or online banking and click on the following:

- Document and Settings

- Manage Cards

- Click the button labeled – TURN CARD OFF

- If you find your card, you can follow the same steps and click the button labeled – TURN CARD ON

-

-

- If you do not find your card or it is compromised, contact the bank as soon as possible and our team will order you a new debit card.

-

Learn More About Card Controls

{endAccordion}

SUPPORT and FAQs

{beginAccordion}

If you get an alert at an unexpected time, does that automatically mean it must be fraud?

No. You may get various unexpected times for subscriptions like Apple, Netflix, and much more. You will also receive alerts at various times from online vendors like Amazon, who charge you when you ship the item, not when you initially check out. Also, alerts could occasionally be delayed. It should also be noted that you’ll receive alerts for credits, too. If you are expecting a refund, you should read the alert closely to see if it’s a credit. It’s always best to review the notification carefully, noting the vendor. It’s also important to note which debit card was used if you have more than one debit card.

Are you supposed to respond to the texts or reply to the emails, stating if the activity is valid?

No, these texts aren’t interactive. The alerts are simply notifications. If a transaction is unauthorized, you will need to turn your card off in Card On/Card Off and then contact the bank as soon as possible. You may call CardSentry if it’s after hours. These are the only valid ways to address the situation.

Learn More About Card Controls

Can you receive both email and text alerts?

At this time, this is not an option. You much choose between email or text messaging to receive alerts.

What if you are set-up to receive alerts, and you are not receiving?

First, check with the bank to make sure the contact information on the card record is correct. Next, check to see that you haven’t blocked that email or number, or if the alerts aren’t going to junk/spam/other folders. You could search by the email ([email protected]) or number (662265) from which the alerts originate.

Can you receive alerts for your spouse’s card?

No. We will only send alerts to the phone number or email address associated with that individual cardholder. We will not share card activity of one individual with another.

Will I still get an alert if I use my mobile wallet, like Apple Pay?

Yes, you will. In fact, you may get two. Your card is being used, just in a safer manner. You’ll probably receive a push notification from your mobile wallet acknowledging the transaction, followed by a card alert.

Are business debit cards eligible for card alerts?

Yes.

Will SPIN transactions generate alerts?

Yes, when you are the recipient – that’s the only time your debit card is used. You will not receive one when you send a SPIN transaction – that uses your checking account. When you receive a SPIN transaction, you’ll get two notifications. One is your original notification of a SPIN transaction like you’ve received for years – the other is a notification that you received a credit through your debit card. See right for the experience after one single SPIN transaction.

{endAccordion}